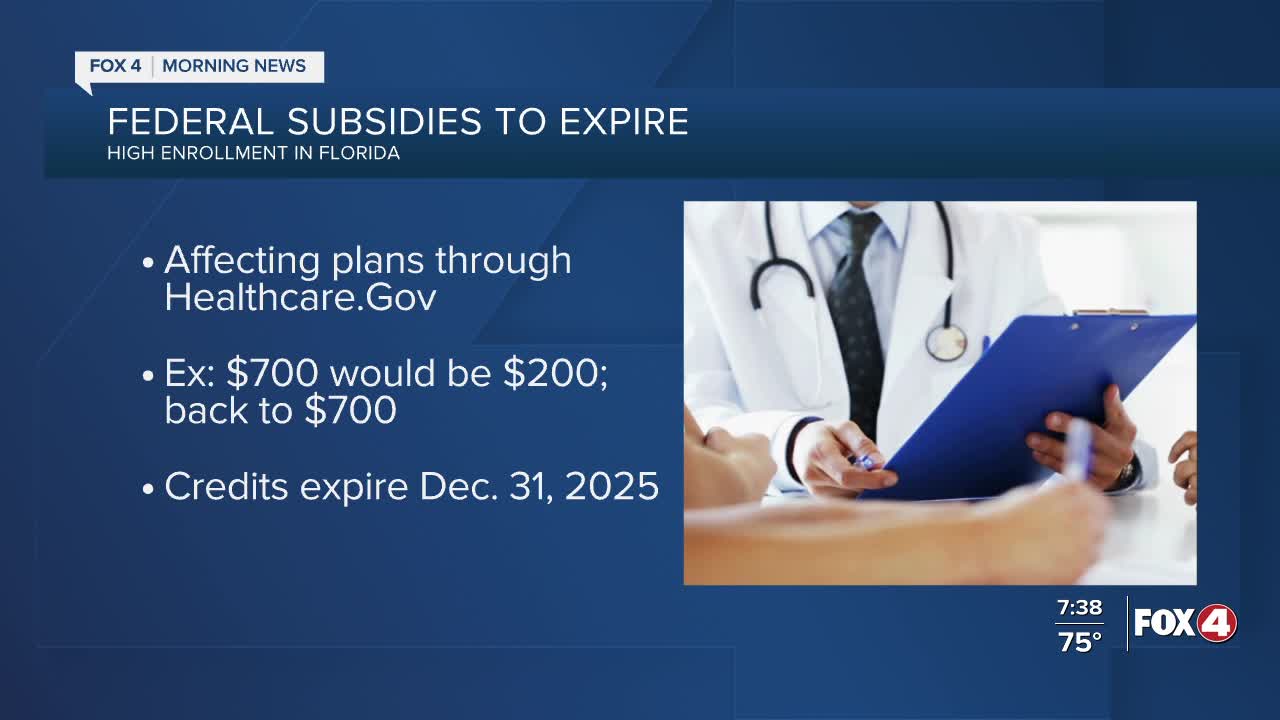

NORTH PORT, Fla. — Southwest Floridians who get health insurance through the Affordable Care Act marketplace may have to remake their budgets when some tax credits expire at the end of the year.

Florida has more people enrolled in the ACA Marketplace than any other state, according to the Department of Health and Human Services. Millions in the Sunshine State depend on that help.

But, the Office of Insurance Regulation announced this month that their premiums could go up anywhere between 23% and 40% with this change.

These enhanced premium tax credits are federal subsidies that lower the monthly cost of insurance bought through Healthcare.gov. They're calculated based on your income and household size. For example, if you have a plan that costs $700, but based on your income and household you're only supposed to pay $200, that means the credits cover the rest of the cost — so $500 in that case. But that all changes after December 31 when these credits expire.

Sue Gottesman from North Port works occassionally as a substitute teacher. Her husband is retired. Together, they're mostly living off savings. One of her sons is on her insurance plan, but thanks to the tax credits, it's a bill she actually never sees.

Now, she said, her family cannot afford this impending price hike.

So, she's planning for her son to get insurance from his job and for her to find cheaper insurance, but it'll likely come with more out-of-pocket costs. It's making her question whether or not to even have health insurance.

"You want to have some sort of insurance, but if it's taking away — we have to have hurricane insurance, we have to have homeowner insurance, we have to have a minimal amount of car insurance, well you have to, you just have to. I suppose you could not but that would be devastating. So of the insurances, I mean health insurance is probably the one you'd want to give up especially if you're healthy," Gottesman said.

If you're on one of these plans, you have until December 31 to adjust.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.