TALLAHASSEE, Fla. — Starting this Friday, Florida families won’t just get a break on back-to-school shopping — they’ll get it every year.

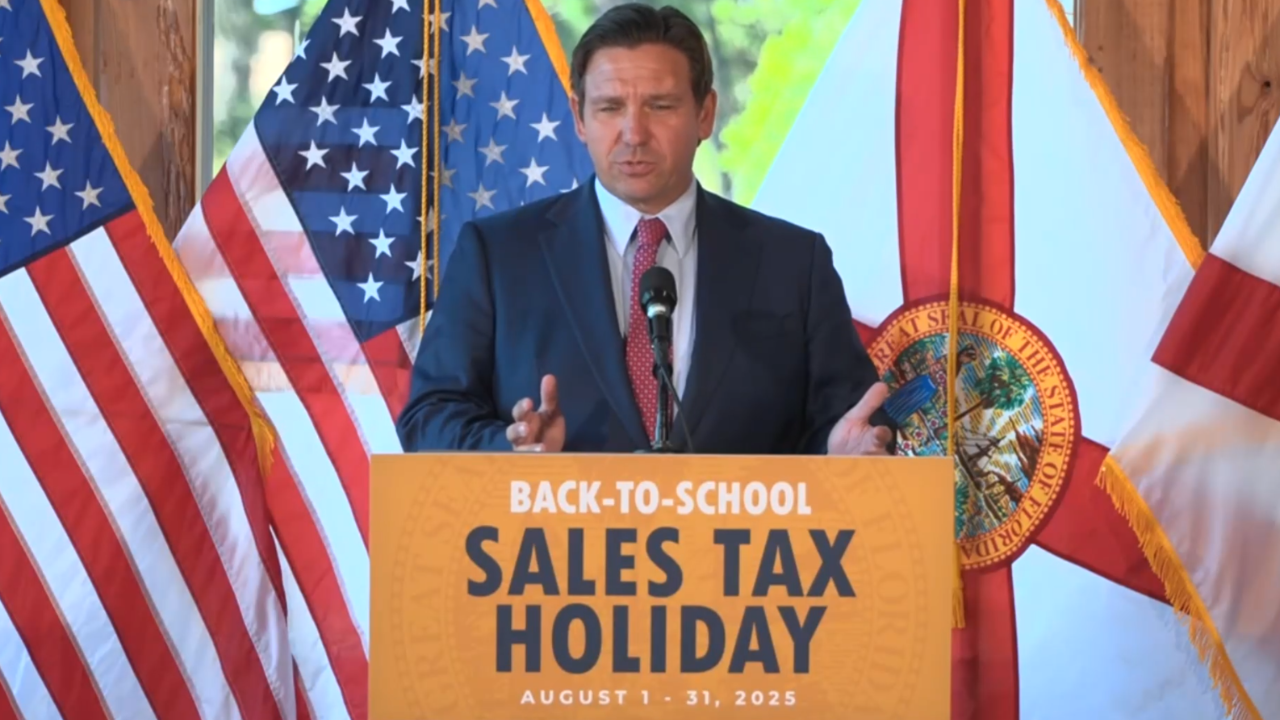

Governor Ron DeSantis recently signed a new law making the state’s annual back-to-school sales tax holiday permanent, part of a $1.3 billion tax package passed by the legislature this year. It marks a significant change from past practice, where lawmakers had to reauthorize the holiday annually, often for just a week or two.

WATCH: Florida makes back-to-school sales tax holiday permanent, but critics say relief falls short

Now, from August 1 through August 31, families can purchase qualifying school-related items tax-free every year. The exemptions include:

- School supplies priced under $50

- Clothing and shoes under $100

- Personal computers and accessories up to $1,500 for non-commercial use

“This is what we’re announcing today — something new for Florida,” DeSantis said at a press conference in Panama City Beach. “It’s longer and permanent, which really makes a difference… It will be every August henceforth, unless the legislature tries to repeal it, which I don’t think they would.”

A Piece of a Larger Tax Relief Plan

The back-to-school holiday is part of a $1.3 billion tax cut package approved by the Republican-controlled legislature in nearly unanimous votes last month. It also makes other temporary holidays permanent, including:

- Year-round disaster preparedness exemptions on items like batteries, generators, and tarps

- State park admissions

- Health and safety items like life jackets, smoke detectors, fire extinguishers, sunscreen, insect repellents, and more

It also creates a temporary holiday for hunting and fishing supplies from September 8 to December 31, exempting guns, ammunition, bows, and related hunting gear.

Education Commissioner Anastasios Kamoutsas praised the permanence of the tax holiday, noting that it provides predictability for families and teachers.

“As a father of four girls, I was extremely excited,” Kamoutsas said. “It gives hope and peace to parents, knowing this is going to benefit them for years to come.”

From $5 Billion to $1.3 Billion: What Happened?

While Republicans in Tallahassee are celebrating the move as a win for families and small businesses, critics say the tax package falls short of what was initially promised. At the start of the legislative session, DeSantis and FL House Speaker Danny Perez had floated a much larger $5 billion plan. Perez sought a sales tax rate cut. DeSantis pursued a property tax rebate program for homesteaded homeowners.

Those plans were eventually scrapped in favor of more targeted tax holidays. Speaker Perez, who had once criticized sales tax holidays, came around to the permanent approach in June.

“We started by saying we're going to cut wasteful spending, we're going to cut recurring taxes, we're going to make sure that this three-year outlook on the state isn't going to be a detriment to future legislatures,” Perez said at the time. “We accomplished that goal. I believe we batted 1000. Did we change our position along the way? Of course, for the better…”

Critics: Too Little, Too Narrow

Democrats and progressive policy groups argue the tax relief package offers only modest benefits for working-class Floridians and fails to address deeper structural problems.

Rep. Fentrice Driskell, FL House Minority Leader, pointed to Florida’s national ranking in teacher pay and rising housing and insurance costs.

“Listen, we’re last in teacher pay. That is unacceptable,” Driskell said. “Florida used to have education as its crown jewel… you’ve got to take care of the issues and the challenges you’re facing today, and that is a failure of this budget.”

The Institute on Taxation and Economic Policy, a left-leaning think tank, also criticized the move. In a brief, the group called sales tax holidays “ineffective and gimmicky,” arguing they do little for the low- and middle-income families who need relief most.

Public Sentiment: Eyes on Housing

Recent polling from the University of North Florida found that housing costs, property taxes, and insurance remain the top concerns among Republican voters. There were concerns that some say were only marginally addressed in this year’s tax legislation.

Still, GOP leaders say they’re not done. DeSantis and Perez have both signaled plans to pursue property tax relief in 2026 through a proposed ballot initiative.

What Families Need to Know

The permanent back-to-school sales tax holiday begins Friday, August 1, and runs through August 31.

To qualify, items must fall under certain price thresholds, and electronics must be purchased for non-commercial use. A complete list of tax-free items can be found at: FloridaRevenue.com/backtoschool.

Abandoned 'zombie house' where owner died undiscovered for years gets stunning renovation

A dilapidated St. Petersburg home where the owner's skeletal remains were found years after his death has been transformed from a neighborhood eyesore to a dream home.